A Passion for Continuous Innovation

London, 30 January 2017 – UK-based microinsurance specialist MicroEnsure, a member of the Business Call to Action (BCtA) since 2012, has made an ambitious new pledge to insure 5 million additional low-income customers while producing three groundbreaking, scalable new products by 2020.

Launched in 2008, the BCtA aims to accelerate progress towards the Sustainable Development Goals by challenging companies to develop inclusive business models that engage people with less than US$8 per day in purchasing power as consumers, producers, suppliers and distributors. It is supported by several international organizations and hosted by the United Nations Development Programme (UNDP).

Consumers in emerging markets face disproportionately high levels of risk, but have little access to insurance products that can mitigate them. Only minute fraction of the 4 billion people living on less than US$4 per day has insurance, leading to financial ruin when major life events such as illness, death and accidents occur. Yet low-income communities face restricted access to formal risk-mitigation mechanisms. Mainstream insurance products are too complex and costly, and are not tailored to the vulnerabilities of low-income consumers.

The estimated US$40 billion market in microinsurance products has been largely untapped: penetration of microinsurance is estimated at less than 10 percent globally. Africa has one of the lowest insurance penetration rates in the world, with less than 2 percent of world market share. The need for innovative and inclusive business models to fill this gap presents a huge challenge, but was seen as a significant opportunity for MicroEnsure.

No insurer had ever been successful in the low-income market before MicroEnsure’s founding in 2002: major insurance companies were hindered by high administration costs for low-value policies, and failed to earn consumers’ trust. By innovating and remaining flexible, MicroEnsure has developed a range of tailored affordable products and an inclusive model for delivering its low-cost solutions to those in need.

Not a traditional insurer, the company partners with insurance and reinsurance companies that can underwrite risk, and mobilizes distribution partners equipped to deliver its products to low-income customers. These include mobile network operators, microfinance institutions, banks and NGOs.

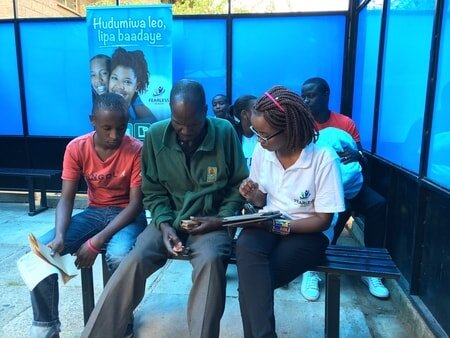

One such MicroEnsure product, Telenor Suraksha, provides life insurance free of charge to mobile network operators, which benefit from the increased customer loyalty that comes from added value. Suraksha made headlines as the fastest-growing insurance product in the world when launched in 2015. Another product piloted by the company is Fearless Health, a comprehensive health financing package sold in health clinics, which allows underserved consumers to access outpatient care without the need to save the $8-12 usually required for medical consultations, drugs and tests. Fearless Health was recognized as a top-20 global health innovation in 2016 by the World Innovation Summit for Health in Qatar.

Since its founding, MicroEnsure has grown into a global company serving over 40 million low- and middle-income customers in 20 countries; 85 percent of them have never before accessed insurance.

“We began MicroEnsure with a passion to bring insurance to those who did not have it”, said Richard Leftley, MicroEnsure’s CEO. “Having proven that meeting the needs of low-income people in emerging markets is good for business, we are ready to innovate new products that protect an even greater number people from the risks they face every day.”

In late 2016 MicroEnsure renewed its BCtA commitment with plans to expand into three new markets and add 5 million new customers by 2020. Serving these new customers with affordable products tailored to fit their needs is expected to increase the company’s annual revenue by US$1 million.

“MicroEnsure has gone beyond disrupting the traditional insurance market”, said Paula Pelaez, Programme Manager of the BCtA. “It is building products that give low-income communities new access to medical care, protection and resilience to the shocks that can devastate vulnerable people’s lives. We look forward to continuing our collaboration into the future.”

For further information:

Business Call to Action: Minja Nieminen at minja.nieminen@undp.org

MicroEnsure: Peter Gross at peter.gross@microensure.com

Membership in the Business Call to Action does not constitute a partnership with its funding and programme partners, UNDP or any UN agency.

About the Business Call to Action (BCtA): Launched at the United Nations in 2008, the Business Call to Action (BCtA) aims to accelerate progress towards the Sustainable Development Goals (SDGs) by challenging companies to develop inclusive business models that offer the potential for both commercial success and development impact. BCtA is a unique multilateral alliance between key donor governments including the Dutch Ministry of Foreign Affairs, Swedish International Development Cooperation Agency (Sida), UK Department for International Development, US Agency for International Development, and the Ministry of Foreign Affairs of the Government of Finland, and the United Nations Development Programme — which hosts the secretariat. For more information, please visit www.businesscalltoaction.org or on Twitter at @BCtAInitiative.

About MicroEnsure: Founded in 2002 within the microfinance network Opportunity International, MicroEnsure has grown to become the world’s largest provider of microinsurance to low-income people. Through partnerships with mobile network providers and others, the company creates innovative solutions to meet the enormous demand for risk-management solutions in emerging markets, and is now expanding insurance protection on an unprecedented scale. New forms of protection for low-income customers include micro-health, political violence, crop and mobile insurance. MicroEnsure has served over 40 million registered customers in 20 countries. For more information about MicroEnsure and its innovative products, visit microensure.com.